ARINDAM CHAUDHURI’S 4 REASONS WHY YOU SHOULD CHOOSE IIPM...

Real estate prices & resistance from small retailers could stop the Reliance juggernaut

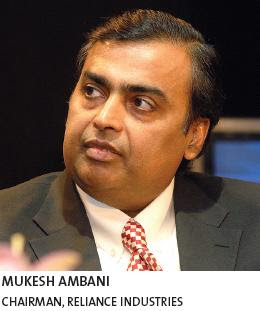

“We a

re not afraid of any competition,” comments Raghu Pillai, President & CEO Reliance, as he interacts with Business & Economy on the eve of the launch of the first Reliance Hypermart in Ahmedabad, Gujarat. Coming from an official at Reliance, that’s hardly a statement that could engender any element of consternation in the listener. Besides growth, nonchalance for competitors has also become a way of life for India’s most valuable company.

re not afraid of any competition,” comments Raghu Pillai, President & CEO Reliance, as he interacts with Business & Economy on the eve of the launch of the first Reliance Hypermart in Ahmedabad, Gujarat. Coming from an official at Reliance, that’s hardly a statement that could engender any element of consternation in the listener. Besides growth, nonchalance for competitors has also become a way of life for India’s most valuable company.As far as retail is concerned, Chairman Mukesh Ambani does have reasons to celebrate. Those anticipating a brutal war happening between Reliance & Wal- Mart, have reasons to be sorely disappointed. The Bharti-Wal-Mart ship, after navigating through cumbersome rules & regulations, is marking a relatively low key debut with wholesale cash & carry operations. Meanwhile, the spectre of Reliance only gets larger, with 240 Reliance Fresh stores already set up & Reliance Digital off the mark. And with Reliance Mart, even the Pantaloons, Tatas & Birlas could find it immensely daunting to match the onslaught.

It’s

interesting to note how the August 15 launch of the 165,000 square feet mall in Hyderabad has been timed with the 60th year of Indian Independence, ostensibly to herald it as another revolution, an ode to the Indian shopper, with his unique tastes & preferences. Mukesh calls it a landmark attempt from Reliance to provide an “international shopping experience to all our customers at unmatched affordability, guaranteed quality & choice of products & services.” The company plans 30 such outlets by the end of 2007 and 500 by 2010, a blistering pace compared to the incumbent Pantaloon, which has only managed 66, since inception in 2001. But the average consumer, who’s already experienced Big Bazaars, may ask, “Where’s the revolution out here?”

interesting to note how the August 15 launch of the 165,000 square feet mall in Hyderabad has been timed with the 60th year of Indian Independence, ostensibly to herald it as another revolution, an ode to the Indian shopper, with his unique tastes & preferences. Mukesh calls it a landmark attempt from Reliance to provide an “international shopping experience to all our customers at unmatched affordability, guaranteed quality & choice of products & services.” The company plans 30 such outlets by the end of 2007 and 500 by 2010, a blistering pace compared to the incumbent Pantaloon, which has only managed 66, since inception in 2001. But the average consumer, who’s already experienced Big Bazaars, may ask, “Where’s the revolution out here?”Maybe

not the pioneer, but has that ever deterred Reliance? States Parimal Nathwani, Group President-Corporate Affairs, Reliance Retail, “Even in Infocomm time (when Mukesh had launched it), Reliance moved to the top very quickly, despite being a late entrant. We grow very fast.” With its plethora of tie-ups, Reliance is diff erentiating itself with a number of unique brands & highly competitive prices. When asked by B&E if the company would like to give a low price challenge like Wal-Mart, the otherwise exuberant Pillai comes up with a very guarded response, “We will be off erring all the products with best possible price. But we will not only fight the price game on price alone...” An insider, on condition of anonymity, revealed that the company was retailing quite a few products at below cost price to attract buyers. Trust Reliance (slated investments of Rs.250 billion in retail), to be able to afford such extravagances.

not the pioneer, but has that ever deterred Reliance? States Parimal Nathwani, Group President-Corporate Affairs, Reliance Retail, “Even in Infocomm time (when Mukesh had launched it), Reliance moved to the top very quickly, despite being a late entrant. We grow very fast.” With its plethora of tie-ups, Reliance is diff erentiating itself with a number of unique brands & highly competitive prices. When asked by B&E if the company would like to give a low price challenge like Wal-Mart, the otherwise exuberant Pillai comes up with a very guarded response, “We will be off erring all the products with best possible price. But we will not only fight the price game on price alone...” An insider, on condition of anonymity, revealed that the company was retailing quite a few products at below cost price to attract buyers. Trust Reliance (slated investments of Rs.250 billion in retail), to be able to afford such extravagances.However,

if Reliance has the strengths of Wal-Mart, it may face quite similar challenges. The first challenge, of course, is real estate. Pillai agrees that huge gambles have to be taken on which property to invest in. To compete on prices, Reliance would try to open up its stores away from the city, but that would turn off customers. When asked about plans for a hypermart in New Delhi, a Reliance official stated plans for one in Ghaziabad. Due to constraints of property, Reliance is not going the franchise route. But with its deep pockets & minimum policy hurdles, Reliance is in a position to take up the best of what’s available.

if Reliance has the strengths of Wal-Mart, it may face quite similar challenges. The first challenge, of course, is real estate. Pillai agrees that huge gambles have to be taken on which property to invest in. To compete on prices, Reliance would try to open up its stores away from the city, but that would turn off customers. When asked about plans for a hypermart in New Delhi, a Reliance official stated plans for one in Ghaziabad. Due to constraints of property, Reliance is not going the franchise route. But with its deep pockets & minimum policy hurdles, Reliance is in a position to take up the best of what’s available.Furthermore, the Wal-Mart experience with bad publicity is known to all. And quite ominously, Reliance is already facing the brunt of small retailers. Reliance Fresh stores have been attacked in Kolkata & Ranchi. Even though Reliance is not ‘foreign’, it’s business model is quite similar to Wal-Mart, and small retailers now dread & despise the way Reliance is spreading its tentacles across the country. In that sense, while Reliance is symbolizing liberation for consumers, it seems to be symbolising subjugation for small retailers. While organised retail is not Reliance alone, the company could unfortunately end up becoming the most likely and visible target for angst.

States

Pillai on the protests, “There will always be opposing points of view, if you see job creation opportunities, the benefits far outweigh the pitfalls. We will lose some links in the value chain. But these will be links that are not adding any value.” He also reiterates how organised retail will be around $60 billion in a span of 5-10 years, which will still be only 15-20% of the total retail space in the country. In addition, Reliance is taking the very critical step of engaging with small grocery shops in the country for B2B opportunities, an initiative which, according to Pillai, would be launched soon.

Pillai on the protests, “There will always be opposing points of view, if you see job creation opportunities, the benefits far outweigh the pitfalls. We will lose some links in the value chain. But these will be links that are not adding any value.” He also reiterates how organised retail will be around $60 billion in a span of 5-10 years, which will still be only 15-20% of the total retail space in the country. In addition, Reliance is taking the very critical step of engaging with small grocery shops in the country for B2B opportunities, an initiative which, according to Pillai, would be launched soon.Clearly, while maintaining superior value for customers will have to remain high on the agenda, Reliance must also ensure that its initiatives to benefit the retail sector as a whole, move much beyond the realms of publicity. Indeed the threat for Reliance is not the competition, but the fear this ‘Gulliver of Indian retail’ strikes in the hearts of adversaries. Surely, it needs more friends among the ‘Liliputs’ than foes!

For Complete IIPM Article, Click on IIPM Article

Source : IIPM Editorial, 2007

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

For More IIPM Info, Visit Below....

IIPM Economy Review

IIPM :- Cicero's Challenge is going global

The Indian Institute of Planning and Management (I...

After CDMA, will nokia miss the 3G bus ?

Time for Awards at IIPM

STUDENTS AGAINST CORRUPTION & KICKBACKS : SACK

Heavy dut(t)y stress Sanjay Dutt Bollywood Actor

The Business of B-School Rankings & The Big Farce

36TH Full Time Programme In Planning & Entrepreneu...